Given the growing support from governments and major consumers of the steel industry – construction, automotive, and household appliances – the green steel market is developing at a rapid pace. Our insight looks at the current development of green steel in top Asian markets – as they race to reach net-zero emissions.

Despite steel being one of the most recycled materials on the planet, the extraction of iron ore and other elements used for steelmaking make the industry one of the most carbon-intensive industries on Earth. Iron and steelmaking represent between 7% and 9% of global greenhouse gas emissions. Sustainable steelmaking requires technology performance improvements and material efficiency. In the long term, innovative technologies would be required for adoption. These include carbon capture, utilization, and storage (CCUS) and production using hydrogen (either as an auxiliary reducing agent in a blast furnace (H2-BF) or as the sole reducing agent (H2-DRI) in a process known as a direct reduction of iron).

Asia’s Bid To Green Its Steel Industry

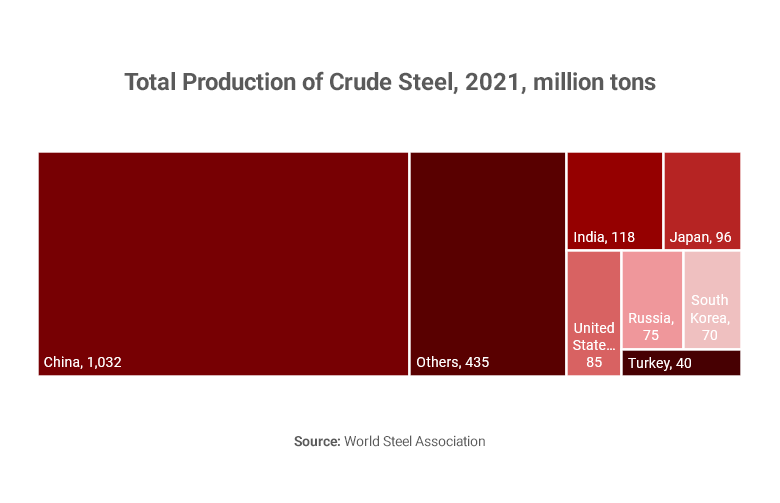

Asia controls a large percentage of the world’s production of steel. China, India, Japan, and South Korea made the top 10 list of steel producers globally. The four countries’ combined production of crude steel accounted for nearly 68% of the world’s total production in 2021. The whole continent, as estimated by the World Steel Association, was responsible for 74% of the crude steel produced globally.

The steelmaking industry in China accounts for about 15% of the country’s total carbon emissions, the same number is 14% for Japan and 12% for India. To accelerate the industry’s transition to cleaner infrastructure, well-designed policies and regulations by the governments are much needed. The Chinese government has set a deadline that the country should reach peak emissions by 2030, 30 years before the targeted date to reach carbon neutrality. The country has been intentionally curbing its steel production to tackle carbon emissions. In 2021, China’s steel production levels finally fell for the first time in 6 years, dropping by 3% year-on-year. The steel output curb is expected to continue, at least until the production of green steel is in place.

At the COP26 climate conference in November 2021, India, Japan, and South Korea backed the Glasgow Breakthrough protocol to decarbonize steel by accelerating the development and deployment of clean technologies and sustainable solutions. The countries also established roadmaps for the national decarbonization of the industry.

Top Steelmakers Pledge to Meet Their Governments’ Targets

The majority of the top steelmaking players have announced their commitment to reach net-zero emissions. Multiple projects were released in recent years, characterized by large investments and global partnerships.

The world’s top steel producer – China Baowu, has established a Low Carbon Metallurgy Innovation Center and a Global Low Carbon Metallurgical Innovation Alliance with partners to promote the green, low-carbon transformation of the steel industry. Consisting of 52 members, including enterprises, universities, and institutes from 15 countries, China Baowu’s Alliance includes some of the top industry players ArcelorMittal, Rio Tino, BHP Group, Thyssenkrupp as its members.

In 2020, Australian mining giant Rio Tinto, together with China Baowu, entered an R&D partnership with Tsinghua University to develop and implement methods to reduce carbon emissions in the steel industry. An investment of 13 million USD will be used to fund a low-carbon raw materials research and development centre. Rio also announced its plans to partner with Japanese Nippon Steel to develop similar technologies. The project intends to become aligned with Japanese climate ambitions, which include reaching net-zero emissions by 2050.

In 2020, the world’s largest mining enterprise BHP also announced its investment of 35 million USD, which aims to develop low-carbon technologies and pathways to reduce emission intensity in integrated steelmaking. BHP will join forces with China Baowu in a five-year-long partnership. The research themes include investigating the deployment of carbon capture, utilization, and storage at one of China Baowu’s production bases. BHP also signed a Memorandum of Understanding (MoU) with China’s second-largest steel producer – HBIS, to invest 15 million USD for the same purpose in 2021. The partnership will prioritize the development of three main areas: hydrogen-based direct reduction technology, recycling and reusing steelmaking slag, and iron ore lump utilization.

In 2021, HBIS implemented the world’s first Direct Reduced Iron (DRI) production plant in China, using “ENERGIRON” technology, developed by Tenova and Danieli. The technology is powered by hydrogen and significantly reduced CO2 emissions in steel making. The final carbon footprint goal will be 125 kg of CO2 per ton of steel, a significant reduction compared to the current average of 1.85 tons of CO2 emitted for every ton of steel.

In 2021, POSCO, along with South Korean giants Hyundai Motor, SK Group, Hanwha, and Hyosung, announced they will invest a total of 38 billion USD to boost the country’s hydrogen economy by 2030. The move came on the back of the “Hydrogen Economy Promotion and Hydrogen Safety Management Act”, the world’s first-ever hydrogen law, passed by South Korea in 2020. In December 2020, POSCO also unveiled plans to build a hydrogen production facility with a capacity of 5 million tons per year by 2050.

In March 2022, Baowu contracted Tenova for designing and supplying a hydrogen-based ENERGIRON DRI plant with an annual capacity of 1,000,000 tons/year. Located in the Zhanjiang Economic and Technological Zone, Guangdong, the plant will be the largest hydrogen DRI facility in China.

The current transition to sustainable infrastructure is thus far only at its preliminary phase in Asia, and the governments are still rolling out support policies to encourage decarbonization. However, large importers of steel products such, as Europe and the US, are setting up more stringent policies and increasing tariffs on products with carbon-intensive manufacturing processes. This urges companies to rush their transition to remain competitive on an international level. The need for changes in the near future has provided strong momentum for green investment and financing in Asia, both cross-border and domestically.

Read more about our industrial goods & services experience or our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.