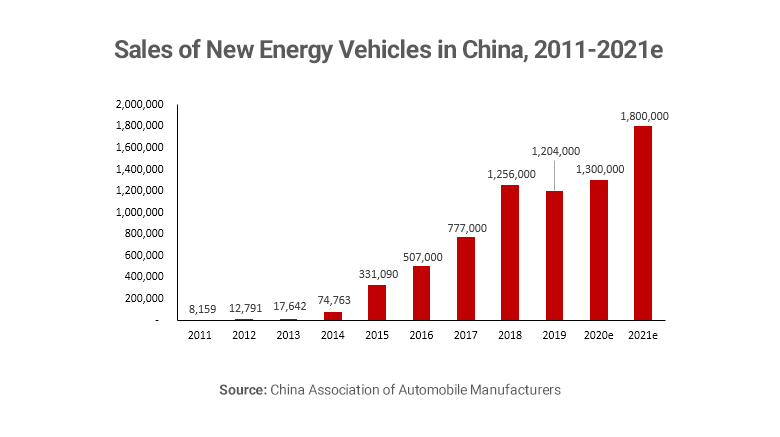

China’s electrical vehicle industry is expected to see rapid growth next year. China Association of Automobile Manufacturers (CAAM) predicts sales topping 1.8 million units next year, compared to an estimated 1.29 million units for the whole of 2020, marking a growth of 40%.

China’s interest for green cars is mounting. With government backed incentives, the industry is expected to keep growing aggressively. NEV (New energy vehicles) buyers in China are eligible to enjoy a 10 percent consumption tax cut. Beijing further offers a cash subsidy of about 22,500 CNY (~3,500 USD) for the purchase of an electric car, as long as the driving range is more than 400 km on a single charge. In Shanghai, the local government gives buyers of NEV’s free license car plates, which otherwise needs to be bought at a cost of around 90,000 CNY (~14,000 USD).

As a part of China’s new 5-year plan (which will be released in its full extent in March 2021), the Government called for a continuous green transformation of production and people’s lifestyles. The clear ambition brings tons of opportunities for companies within the Energy & Environment sector, producers of electrical vehicles being one clear winner. By 2025, deliveries of green cars are expected to account for a fifth of the market, up from less than 5 percent in 2019.

Many new players are joining the race to grab a share of China’s gigantic car market. The three Chinese NEV brands NIO, Xpeng and Li Auto, listed on the New York Stock Exchange, has seen a rapid interest increase lately. Now, the list of the world’s most valuable automakers has been reshuffled. NIO has a market cap (as of December 2020) of 66 billion USD, while Xpeng and Li Auto are valuated to 34 billion USD and 28 billion USD respectively. Putting this into perspective, we find Ford’s market cap being 36 billion USD and Nissan 22 billion USD. Adding to that, Tesla targets the Chinese market more and more, with the initial production of their newest model, Model Y, already in production at Tesla’s enormous Gigafactory in Shanghai.

To further build the hype around China’s NEV market, it is reported that Baidu is considering making its own NEV’s, and have held discussions with several carmakers about the possibilities of collaborating on this co-development. Baidu, which is commonly referred to as “China’s Google”, are the latest tech-firm to join the race for developing smart cars. Building cars would mark a checkpoint of dramatic development in Baidu’s push to diversify income streams.

However, Chinese carmakers need to overcome a shortage of semiconductors (caused by the COVID pandemic) before being able to rev up the production next year. Lockdowns in Europe has disrupted the production of semiconductors, which is a key component for all carmakers and car parts suppliers, including the Chinese ones. Some assemblers might be forced to reduce, or even halt output completely, unless the bottleneck of semiconductors is being solved.

In conclusion, the sales of Chinese electrical vehicles are expected to rise dramatically next year. Driven by a desire to transform China to a more climate neutral and green nation, the government offers highly lucrative incentives for its citizens. Many companies are now trying to grab a share of China’s huge car market, but they all face a shortage of semiconductors which has to be solved before ramping up the production.

Read more about our automotive sector expertise or other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.