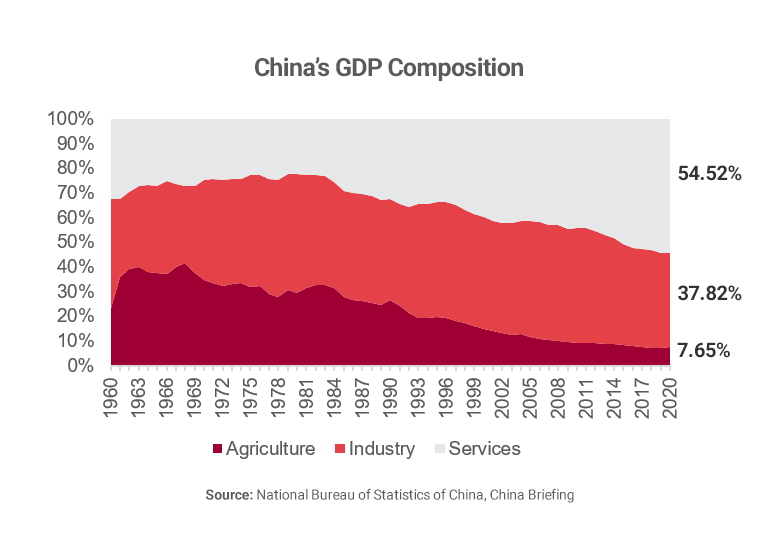

China’s service sector plays a vital part in the country’s economy. In 2020, the services industry accounted for 54% of China’s GDP and 60% of its total economic growth. Starting with Beijing, China has issued multiple initiatives to help foster the growth of the service sector, including adjusting several regulations related to foreign investments in the industry.

China’s Service Sector

Replacing Agriculture and Industry, Services became China’s largest sector by GDP composition, contributing 54.52% of the country’s GDP in 2020. China’s service sector is comprised by multiple industries, including warehousing and transport services, information services, securities and other investment services, among others.

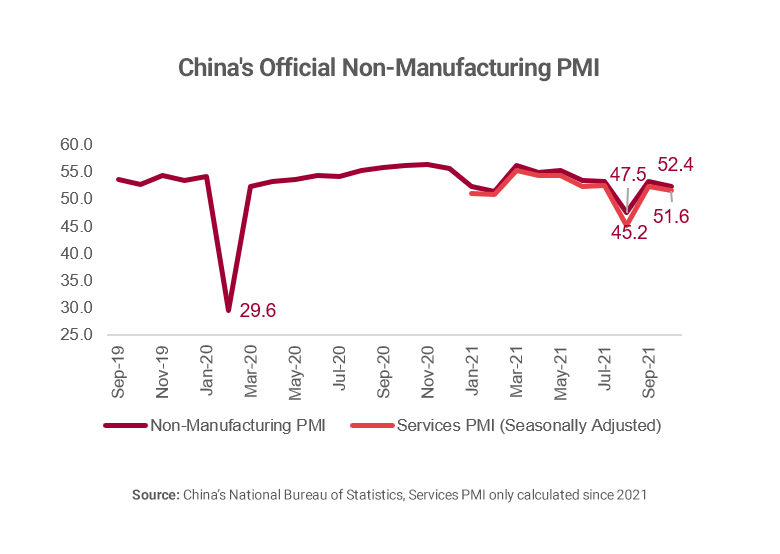

The health of the industry is measured by two Purchasing Managers’ Indices (PMIs). One PMI is released by the National Bureau of Statistics measuring the sentiment among large services firms, many of which are state-owned. Another PMI, produced by Markit for Caixin magazine, mainly measures sentiment among smaller, mostly private firms. A reading above 50 indicates growth in the services sector and vice versa.

China’s official non-manufacturing PMI, which measures the sentiment among services and construction sectors, dropped to 29.6 in February 2020 amid intensive pandemic lockdown. Meanwhile, the Caixin/Markit services PMI fell to 26.5 in February from 51.8 in January 2020. Both PMIs recovered to above 50 in the following months. A shorter dip in non-manufacturing PMIs was recorded in August 2021, due to another COVID-zero lockdown that severed multiple business and social activities.

Expansion of Chinese Services Sector Spearheaded by Beijing

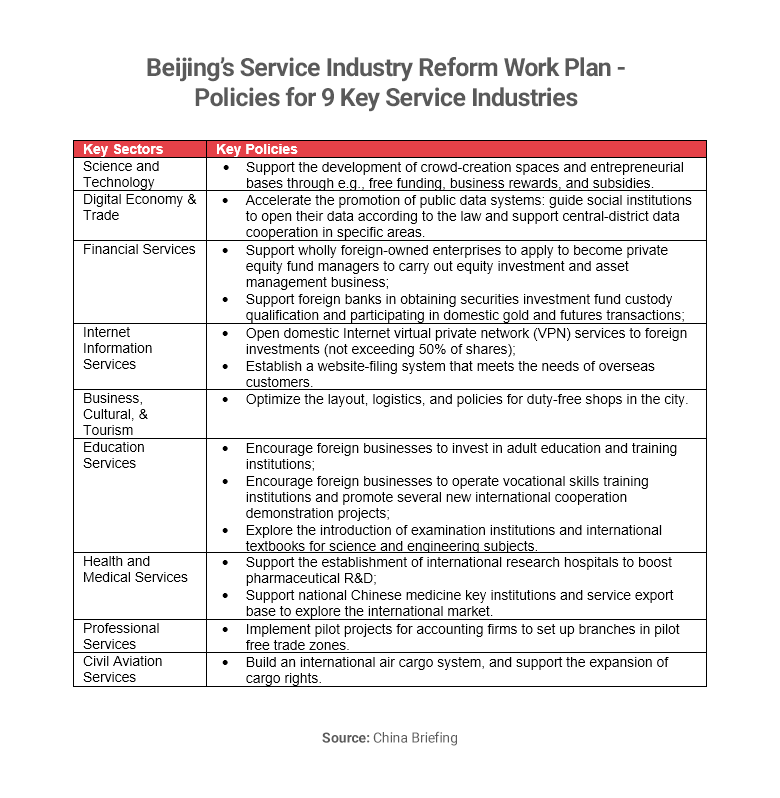

Targeting Beijing, multiple policy changes have helped improve the market accessibility of China’s service sectors. Beijing has previously announced four different rounds of service industry openings – in 2015, 2017, 2019, and 2020. The New Round of Service Industry Expansion and Opening up Comprehensive Demonstration Zone Work Plan was delivered in September 2020. The 2020 Work Plan is comprised of 120 policies and measures aiming to enable the gradual opening of Beijing’s service sectors.

Nine key service sectors were selected to undergo reforms to relax market access and expand the development of existing industrial parks or ongoing institutional and supply-side reforms. The financial services industry has received the most attention with 26 new policies. Measures under this sector include either relaxing market access restrictions or optimizing the market environment in which businesses operate.

Ease of Restrictions on Foreign Investments

On October 18, 2021, China’s State Council announced that it had permitted Beijing to temporarily adjust certain regulations to enable more access to areas of the services sector for foreign investors, including the embattled education sector. Foreign investors would be able to participate in for-profit adult education and vocational training institutes.

The adjustments in regulation will allow foreign investors to participate in Beijing’s thriving service sector by expanding access to previously restricted areas. The equity cap on internet service providers will ease foreign telecom companies’ entry into Beijing. Foreign operators in the education services sector will receive a legal pathway to enter China, while foreign tourist agencies will be able to operate overseas tours for Chinese tourists.

China’s services sector has been playing a dominant role in the economy, with its share of GDP higher than the primary (agriculture) and secondary (industry) sectors. The service sector is unique due to its dependence on soft labour factors such as expertise and innovation. Because of this, it is widely considered that an open and transparent business environment, that allows cross-border connectivity of information, data, capital, and personnel, is the foundation for the growth of the industry. While there are multiple areas within the services sector that will remain off-limits, it can be expected that China will further adjust its regulations to broaden foreign investors’ access in the field.

Read more about our consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.