Vietnam has emerged as one of the fastest-growing markets in Asia, being the 10th largest trade partner of the US and the 16th largest of the EU. With a population of nearly 100 million people along with a fast increase in the middle and high-income groups, Vietnam shows increasingly greater demand for imported food products.

Main import markets include the EU, the US, Korea, Japan, and Australia. Products from these countries are often considered to be of higher quality than domestically produced ones, at the same time as the Vietnamese get an increased appetite for foreign products.

The EU-Vietnam Free Trade Agreement (EVFTA) came into effect in 2020 and has created ample opportunities for both Vietnam and EU enterprises to expand their businesses locally, with decreased or eliminated tariffs for more than 99% of traded goods.

In this article, we review what products are in demand in Vietnam, the import process, as well as the import duties.

What food products are in demand in Vietnam?

Vietnam is a big producer of food products, and some are already supplied by domestic producers, leaving less room for foreign enterprises. In this article, we only review the most noteworthy categories with a strongly growing demand and explain the trends for these.

Fresh fruits and vegetables

In 2020, fresh fruits and fresh vegetables ranked as the first and the third most imported food products by value. Both are important for Vietnamese diets, and it doesn’t come as a surprise that Vietnam is one of the biggest consumers of fruits and vegetables globally.

The import value of fruit also increases as Vietnamese consumers pay more attention to the quality of the products. Moreover, while tropical fruits used to be dominant as they grow in abundance in Vietnam and are sold at low prices, Vietnamese are now willing to spend more for other types of fruits. Main imports from the EU include apples, plums, peach, grapes, cherries, and olives.

Among the European Geographical Indications (GIs) indicated by the framework of EVFTA we find:

- Kiwi Latina: Kiwi fruit from Italy

- Cítricos Valencianos (Cítrics Valencians): Citrus fruit from Spain

- Pêra Rocha do Oeste: Pears from Portugal

- Pruneaux d’Agen (Pruneaux d’Agen mi-cuits): Prunes from France

- Mela Alto Adige (Südtiroler Apfel): Apples from Italy

Fresh and processed meat

Meat consumption has increased much in Vietnam in the last decade and pork accounts for around 70% of the total consumption. It’s currently the second-biggest pork consumer, just behind China, and spent more than 600 million USD in 2021 on imports of pork.

The demand for fresh beef has risen sharply thanks to the growth of the Vietnamese middle class, as the product is more expensive than pork. Imported beef is mainly used in luxury restaurants, hotels, high-end outlets, and meat-oriented chains. Main export markets include Australia, the US, and Canada, partly due to the lower tariffs.

Processed meat commonly consumed includes sausage, bacon, and ham. If you are a German sausage producer and plan to enter the market, you already have an advantage in branding as the “German sausage” is widely known among Vietnamese as the best sausage that is worth trying. Sausage is widely used in many dishes such as the famous banh mi, which is a traditional baguette.

Dairy products

Vietnam’s domestic production of dairy products only meets around 30% of the consumption, resulting in a need to import dairy products. One of the reasons is the country’s climate, which is not favorable to raise dairy cows. Raw milk is therefore primarily imported from Australia, the EU, New Zealand, and the US.

Cheese and butter demand is fueled by exposure to Western culture, and consumers often choose imported cheese and butter rather than the limited choice of domestic brands, if they choose quality over price.

The demand for imported baby formula also continues to increase, thanks to Vietnam’s growing population and the increased disposable incomes. We see significantly higher usage of baby formulas compared to Western countries and around two-thirds of Vietnamese families buy the products.

Dairy products

Vietnamese have become more health-conscious and understand the benefits of olive oil, increasing the demand for the product. There is a big demand for vegetable-originated oils, and olive is one of the most popular options. The market relies on imports of olive oils from foreign countries, primarily Spain, Italy, and Greece.

Process when Importing Food Products to Vietnam

Most categories of imported food must undergo inspections. Depending on the product types, the following bodies are responsible for different food categories, implementing Law 55/2010/HQ12:

- Ministry of Health (MOH): Responsible for most pre-packed and processed food products

- Ministry of Agriculture and Rural Development (MARD): Responsible for agricultural products

- Ministry of Industry and Trade (MOIT): Responsible for higher-risk foodstuffs, such as alcoholic beverages, processed milk, and edible oil

Notice that the import procedures will differ depending on your products, make sure to check the regulations from the corresponding authorities mentioned above.

Some general steps for the imports of fresh fruits are as follows.

Step 1: Check the import list

First, you need to check if Vietnam allows imports of your products from the country of origin. For fruit and vegetables, you can check the website of the Plant Protection Department.

Step 2: Apply for a phytosanitary license (if required)

The list of items can be found in Circular 24/2017/TT-BNNPTNT, showing that tubers, fruits, and seeds will need a phytosanitary permit before being imported.

Step 3: Product registration and quarantine at the border gate

Prior to imports, you must register the products with the customs. The products will also be in quarantine before the products have been tested.

Step 4: Quarantine sample

When the registration is completed, and after the goods arrive at the airport or seaport, the importer (or service company) coordinates a visit to the warehouse with the quarantine officer to collect the goods and to take samples.

Step 5: Import customs procedures

Currently, the Vietnam custom procedures are defined under Law No. 54/2014/QH13. For processed and packaged food, the importers need to:

- Perform product disclosure or product self-declaration

- Apply for a certificate of food safety eligibility

- Carry out relevant customs procedures for imported food

- Inspection by a government-appointed authority

Import Duties for Food Products in Vietnam

To find the applicable import duties, you should first check the HS codes. More detailed guidelines and full tariff information for EU countries can be found here. Below are HS codes of some of the most imported products in Vietnam:

- Fruits: Cherry: 08092100; Apple: 08081000; Grape: 08061010; Peach: 08093090

- Meat: Frozen beef, boneless: 02023000; Frozen pork: 02032900; Canned pork: 16024999; Pork sausage: 16010090

- Dairy: Mozzarella Cheese: 04061010

- Olive oil: 15091010 (Olive oil and its fractions, whether refined, but not chemically modified. Packed with a net weight not exceeding 30 kg)

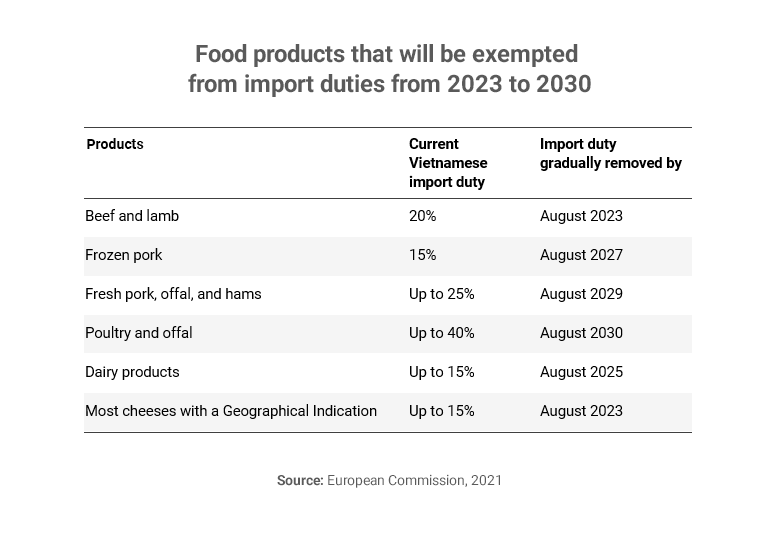

Under the free trade agreement with the EU (EVFTA), the import duties for the above-mentioned products will be gradually removed by 2027. For example, beef is currently subject to import duties of 20%, but will be exempted from import duties by 2023, giving EU exporters a great price advantage.

Below you can find a list of food products that will be exempted from import duties from 2023 to 2030.

Summary

Vietnam is a high-potential consumer market for food products as its middle and high-income class is growing fast, along with its strong population growth.

The country’s openness to trade has made the market even more attractive, and food producers from the EU should expect a fast growth in the demand for imported food products in the future.

EU countries benefit strongly from the European Union–Vietnam Free Trade Agreement (EVFTA), which was introduced as late as 2020. Many exporters are still unaware of this free trade agreement, which will get increasingly more attention in the coming years.

With that said, it can be complex to manage local registration processes, particularly if you have no or little experience in the Vietnamese market. Assure that you work with a reputable service provider that can help you in the process to avoid any pitfalls later.

Read more about our market entry & expansion experience or other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.