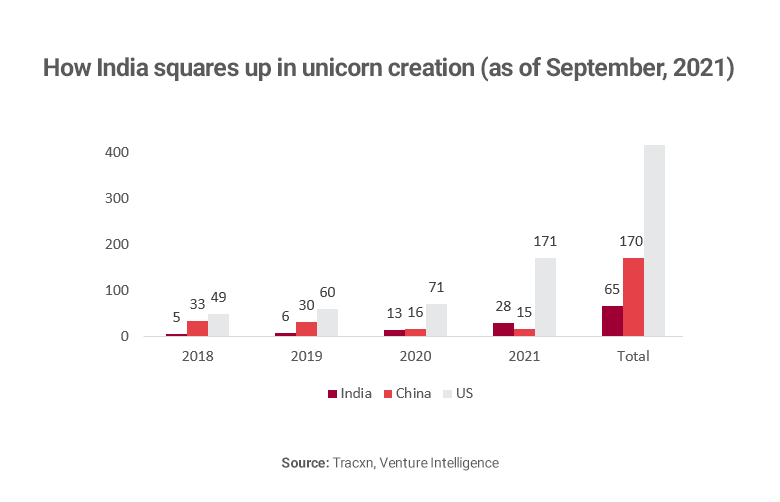

India is an increasingly attractive land for investors. 28 new companies joined the unicorn list in 2021, indicating promising future robust capital markets. Foreign investment into India grew by 90% during the first three months of the fiscal year, confirming a global appeal in one of the best-performing markets in the region.

A New Unicorn Every Three Months

‘Unicorn’ is the term coined by the venture capital industry to address private-held startup companies with a valuation of $1 billion or above. Currently, the country with the most unicorns is none other than the US, where around 50% of the unicorn share belongs to Silicon Valley. Racing behind is China, the host of the world’s most valuable unicorn company ByteDance. India strives to close the gap in third place, with a record number of investment during the year as of September 2021.

India marked 2021 as its most productive unicorn minting year to date, with 28 new startups reaching unicorn status as of September. That is over 40% of the nation’s total number of unicorns. This strong growth in billion-dollar startups signifies the country’s maturing startup ecosystem, as well as investors’ increasing confidence in its value creation opportunities.

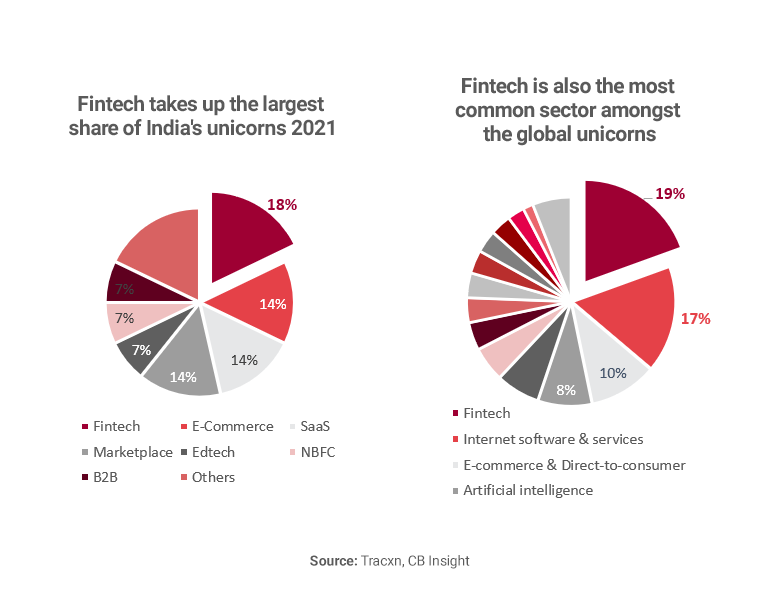

The majority of the recorded Indian unicorns up until September 2021 are in the Fintech sector. Four of the new unicorns are in e-Commerce. A similar number is recorded for the SaaS (Software as a Service) and the marketplace (manufacturing, human resources, secondhand products) segment. Edtech, NBFC (Non-Banking Financial Companies) and B2B (business to business) sectors garnered two new unicorns each. The rest of the 2021 unicorn list are startups in gaming, cryptocurrency, logistics services, social media, and conversational messaging.

This sectoral trend is also observable globally. By September 2021, 162 out of the global 832 unicorns belong to the Fintech category. 8 out of the UK’s 9 unicorns in 2021 (September) were in the Fintech sector. Fintech also leads the 2021 unicorn batch in China with four new startups up until. The Fintech sector in the US has introduced 49 new unicorns in 2021, only one less than the internet software and services sector. The growth in Fintech startups is backed by the strong interest among investors. Fintech investments reached US$98 billion in the first half of 2021, $52 billion of which is from VC (Venture Capital) investment.

India’s 2021 batch also welcomed the historically fastest startup to reach unicorn status, the 21-month-old hiring startup Apna.co. The company became the world’s second-largest internet market to reach unicorn status. Asides from the coveted unicorn title, 32 Indian startups are titled gazelles (valued at over US$500 million) and 54 are cheetahs (valued at over US$200 million).

Investors Rush to India for Unicorn Hunting

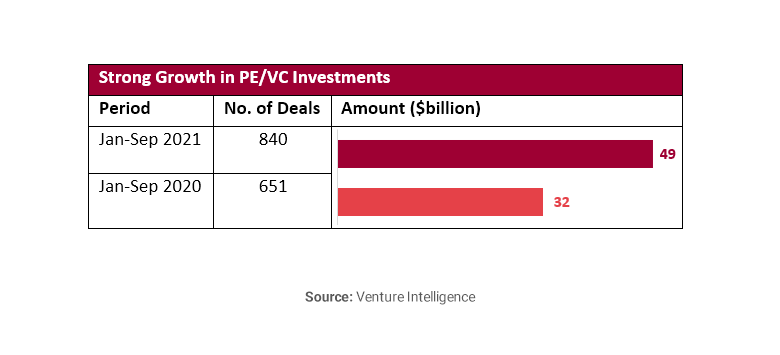

India is undoubtedly one of the most attractive markets for global investors. Foreign investment to India totalled at US$22.5 billion in the first three months of the fiscal year, which started on April 1st. That is 90% higher than the same period 2020. Between January and September of 2021, 840 venture capital deals were announced with a disclosed value of US$49 billion.

Collectively, Indian unicorns are valued at around $300 billion. The opportunities are abundant for early and late-stage investors as well as retail ones. A record number of unicorns and start-ups have announced their plans to list in the stock market.

Food-delivery company Zomato Ltd. became the country’s first unicorn to make its stock market debut in 2021, raising US$1.3 billion and backed by Morgan Stanley, Tiger Global, and Fidelity Investments. Fintech unicorn Paytm filed a prospectus together for what could potentially become India’s largest IPO. The lineup also includes e-commerce giant Flipkart and ride-hailing startup Ola. The momentous wave of startups going public helps ease investors fear of Indian startups’ ability to be listed.

Attractive investment opportunities are extended beyond the equity market to the overall capital market, including debt issuance. There is also a growing interest in the more sophisticated instruments of derivatives, bonds, and other markets. Indian tech companies “can attract global investors who’ve burnt their hands in Chinese tech companies,” said Nilesh Shah, group president and managing director at Kotak Mahindra Asset Management Co in Mumbai.

Once a startup goes public or gets acquired, it will no longer be considered a unicorn. That fact alone makes some venture investors relentless in their hunt for the next unicorns. Tiger Global, Sequoia Capital and other venture giants are directing their attention to India with Tiger Global being the leader of the pact. A significant number of newly generated Indian unicorns are backed by Tiger Global. The investment firm raised US$6.65 billion for its 13th fund, a major proportion of which is set to invest in India.

India is one step closer to prove itself as the next big startup hub with a very high record number of unicorn births in 2021. The momentous rise of unicorns in India was fostered by a strong growth in overseas investments, supporting local startups in their transformation and scaleup strategies. 2021 also marks the first listed unicorn from India, signaling great investment opportunities for interested investors.

Read more about our private equity expertise or our consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.