In an attempt to restore the nation’s economy amid the pandemic, the Indonesian government extended its luxury tax break for sales of small cars, first enacted in March 2021, until year-end. The incentive has paved the way for the industry’s impressive recovery. However, challenges remain.

Indonesia, the second largest automobile manufacturing nation in Southeast Asia, faced a severe decrease in both demand and supply for cars due to COVID-19. From nearly 1.3 million cars produced in 2019, the country halved its production to around 690 thousand cars in 2020. Reduced consumer demand and halted production due to movement restrictions tied back Indonesian car sales until February 2021.

Luxury Goods Tax Relief Enabled Recovery of the Automotive Industry

The Indonesian government imposes a luxury goods tax (Indonesian: Pajak Penjualan atas Barang Mewah (PPnBM)) on vehicles based on engine displacement and body type. With an exemption of low-cost and energy-efficient cars, such as Toyota Agya or Honda Brio Satya, automobile sales are charged 10-125% of tax percentage.

The PPnBM was first relieved in early March 2021 for sales of new cars with an engine capacity of less than 1,500 cc. The incentive targets the automotive sector and related industries, which contributed 10.16% of the country’s GDP and employed more than 1.5 million people in 2018.

The original plan stated a 100% government support of the tax payment from March to May, 50% from June to August, and 25% from September to November. In June, the government extended the relief to fully bear the tax on sales of small cars until August and half of the tax on new purchases made from September to December. The latest extension of the tax relief, announced in September, will be in place until the year-end. The government also allowed a 25%-50% tax discount for cars of more than 1,500cc to 2,500cc capacity.

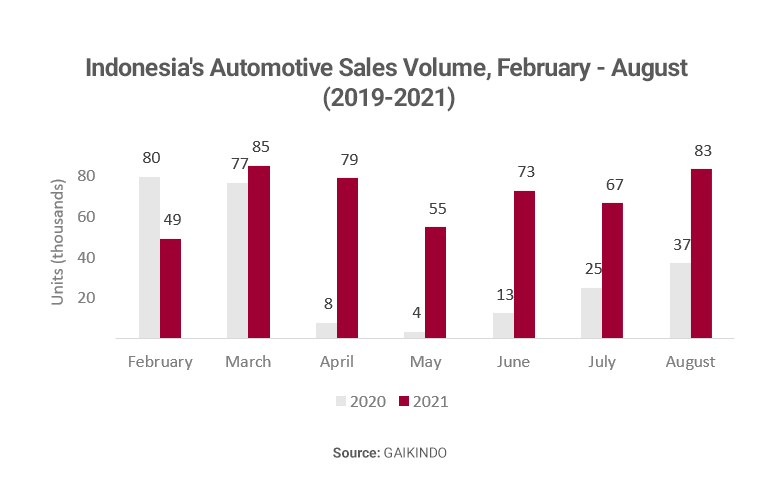

Since the initial implementation of the policy, sales in March rose to 84,910 units, marking a growth of 73% month-on-month (MoM) and 10.5% year-on-year (YoY). This remarkable jump slightly dwindled throughout the second and third quarter. However, YoY growth was sustained at a high level, significantly at 1443.6% in May.

In August, the Indonesian automobile manufacturers association (GAIKINDO) reported total national car sales of 83,819 units, reaching close to the country’s pre-pandemic level of monthly sales volume. Cumulatively from January-August 2021, retail car sales reached a total of 545,424 units, equivalent to a 68% growth compared to last year, signifying a positive consumer response to the tax incentive.

Expansive Production Meets Domestic Demand and Exports

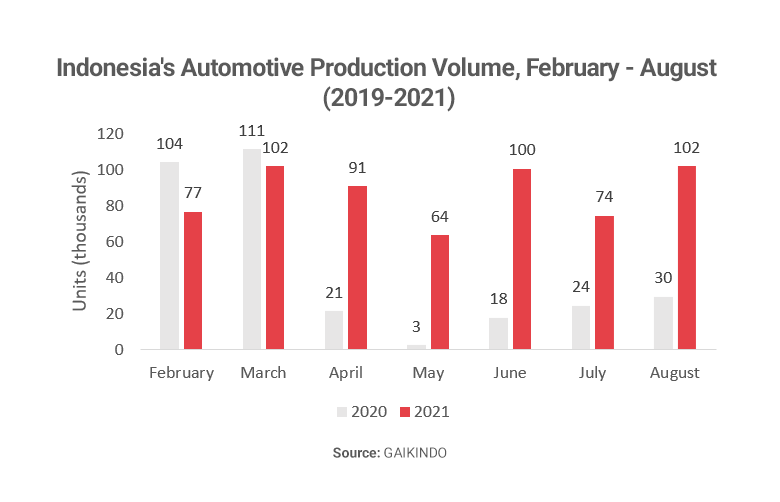

The jump in demands allowed car production to increase in the same manner. Despite increased movement restrictions from May due to a surge in COVID cases, the production results showed positive YoY growth. As the country managed to subdue its infection rates from August, a strong bounce back in production was visible in the month’s production result. Production from January-August marked a 65.8% increase YoY.

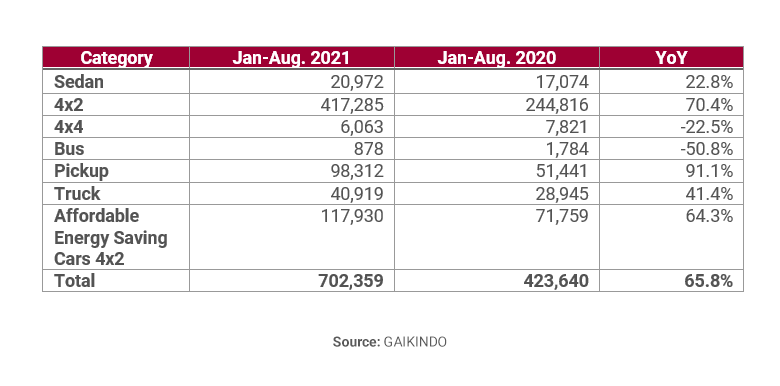

From January-August 2021, the 4×2 passenger cars production benefit heavily from the tax incentive, recording a 70.4% YoY growth compared to 2020. Meanwhile, the production of 4×4 passenger cars, which receives a 25% discount in PPnBM, has not been equally fruitful. However, comparing with August 2020, 4×4 production in August 2021 has shown a significant increase YoY.

There’s also a noticeable growth of 64.3% in the Affordable Energy Saving Cars 4×2 category, originally already free from the luxury tax. As the government push for more environmental-friendly solutions in the domestic automotive industry, Energy Saving Cars are expected to meet with elevated demand in the near future.

Challenges Remain on the Road to Recovery

Automotive sales during the last quarter of the year have been historically the most lucrative. With generous governmental support, the industry could expect to reach 1 million units in production and 800 thousand in sales. However, there are challenges to surpass in order to realise this potential.

Since its introduction in March 2021, the tax incentive has helped boosted domestic car purchases, with its subsequent extensions considered to have further accelerated the recovery of the automotive industry. The industry welcomes positive projections toward the end of 2021. However, the current global pandemic and semiconductor shortage may challenge the nation on its road to recovery.

Read more about our market entry and expansion services or our automotive expertise.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.