Indonesia, the largest economy in Southeast Asia, has experienced a steady economic growth of around 5% per year for the past decade. The country boasts abundant natural resources, a large domestic market with increasing purchasing power, and a young population.

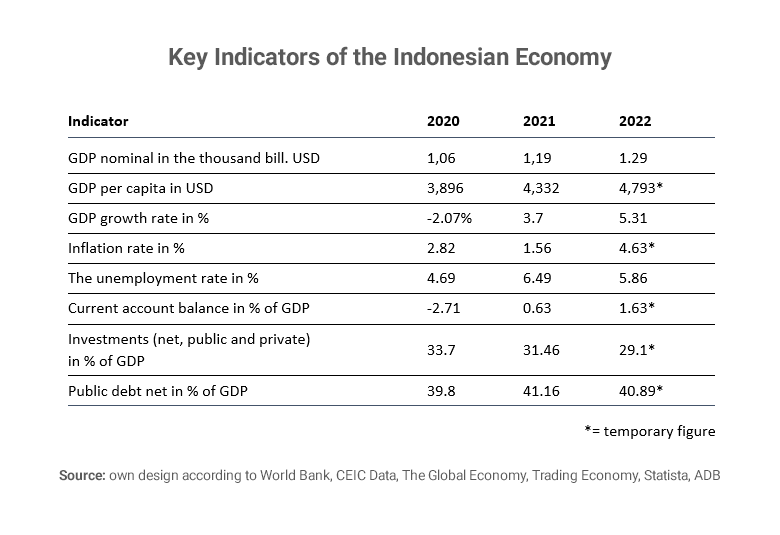

With a population of over 275 million, Indonesia represents more than one-third of ASEAN’s population, making it the most populous country in the region. As the largest economy in the region, Indonesia’s economy accounts for more than one third of ASEAN’s gross domestic product (GDP), which is estimated to be around USD 1.18 trillion in 2022. This potential has made Indonesia a likely candidate to become the ASEAN hub in the coming years. PwC projects that Indonesia will become the fourth largest economy in the world in 2050, behind China, India, and the US.

Public investment in infrastructure and friendly policy measures for a better private investment climate are the key factors driving the country’s economy. The government has implemented some reforms, including liberalizing some trade measures, cutting fuel subsidies, and improving tax compliance to free up funds for infrastructure development.

Private consumption is one of the main driving forces of Indonesia’s economy, with all economic activities predominantly directed at the domestic market. In 2022, private consumption reached 51.87% of GDP, and historically, the average contribution of private consumption has been 59.1%. In most of 2022, the central bank (Bank Indonesia) maintained low interest rates, which helped maintain a robust growth rate in household consumption.

Indonesia’s Consumer Market

With the fourth largest population globally and a growing middle class, Indonesia is an attractive destination for businesses looking to expand. Major brands in consumer goods have already established their business activities in Indonesia, and the society’s fascination with branded goods has increased business potential in the market. For instance, IKEA established its business in 2014 with one store, and within a year of opening, the company managed to sell 12 million products. Since 2019, the company has opened four more stores in the country.

The fast-moving consumer goods (FMCG) sector is a significant contributor to Indonesia’s economic growth. The primary growth factors in the industry are growing consumer spending power due to increased personal income and growing urbanization.

On average, Indonesian families spend about 20% of their entire household spending on FMCG items, with the food segment making a major contribution. The sector was the least impacted during Covid-19, and most major multi-national companies (MNCs) have established their presence directly in the country to take advantage of the benefits offered by the consumer market.

How the Pandemic Affected Consumer Behaviors

The pandemic shifted consumer behavior and increased the use of digital technology in daily life. Data traffic, e-learning, digital payments, e-government, and e-commerce have all experienced increased demand. Between 2020 and 2021, the increase in mobile connections was almost in line with the growth of the population, with an additional 27 million internet users covering 73.7% of the country’s population. Covid-19 has accelerated the adaptation of ICT by the large base of dynamic, young, and digitally minded workforce and consumer base.

Health and hygiene products have seen a surge in demand as people become more conscious of their health and safety. Besides, e-commerce has become the preferred way to shop as consumers prioritize convenience and safety. Not to forget, online grocery channels have seen a significant rise as people avoid crowded places. Finally, with people spending more time at home due to the pandemic, home entertainment has become more popular.

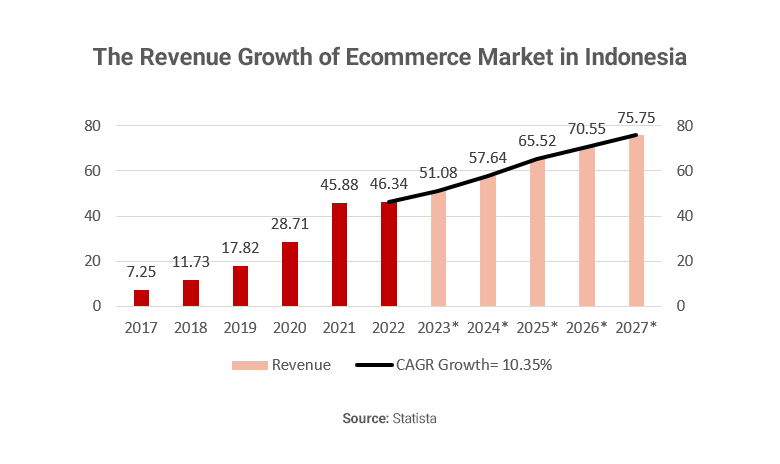

While some changes have reverted due to the easing of COVID-19 restrictions and the return to normal activities, e-commerce and online grocery channels have maintained their strong position. Indonesia’s e-commerce market is one of the largest in the world, ranked 10th globally, and will rank 4th by 2030. According to the latest study, the compound annual growth rate for e-commerce in Indonesia is projected to be 10.4% during the medium term (2023-2027), with a projected market volume of USD 75.75 billion in 2027.

The Indonesian B2B Market

According to the Indonesian Central Statistics Agency (BPS), the manufacturing sector had the highest share of the GDP in 2022, accounting for 18.34%, followed by the mining sector with 12.22%.

Within the manufacturing industry, subsectors such as food and beverage, chemical, transportation equipment, and metal goods including computers and electrical equipment were deemed important. The retail sector contributed 12.85% of the GDP, while Agriculture, Forestry, and Fisheries made up 12.40%. These sectors are considered vital to the country’s economy.

In 2018, Indonesia initiated the Making Indonesia 4.0 program, aimed at revitalizing the manufacturing industry through the adoption of Industrial Revolution 4.0. This initiative provides great potential for the country to increase labor productivity, boost global competitiveness, and increase its share of the global export market. The government’s targets include becoming a global top 10 economy by 2030, doubling the productivity-to-cost ratio, pushing net exports to 10% of GDP, and allocating 2% of GDP for research and development.

To achieve these objectives, the government is developing five major manufacturing industries: food and beverage, textiles and apparel, automotive, electronics, and chemicals, as they are among the most competitive industries in the region. These five industries contribute 60% of the manufacturing GDP, 65% of export-manufacturing, and employ 60% of the manufacturing workforce.

Some of the steps taken to achieve these targets include reforming the flow of goods and materials, embracing global sustainability trends, empowering SMEs, building nationwide infrastructure, attracting foreign investments, establishing an innovation ecosystem, incentivizing technological investment, and re-optimizing regulations.

Indonesia’s Net Zero Emission Targets

With the Net Zero Emission 2060 initiative becoming a long-term program from the government, strategic industries such as power, oil and gas, and mining have intensified their efforts to invest in technology. These industries are also controlled by the government through the presence of state-owned enterprises. Private companies are also seeking suitable technology to meet potential demand when carbon trading is implemented in the near future.

The country’s greenhouse (GHG) gas emissions reduction target is 29% unconditionally and 41% conditionally (with international support) by 2030, with renewable energy and energy efficiency being the primary measures to achieve these targets. The year 2030 will serve as the baseline for reviewing the country’s progress towards achieving Net Zero Emission by 2060.

B2B e-commerce has also witnessed remarkable growth in recent years, with the Indonesian B2B e-commerce market valued at USD 51.43 billion in 2021, registering a CAGR of 7% during 2015-2020. The B2B e-commerce market serves as a procurement channel for some companies and a marketing channel for micro, small, and medium enterprises (MSMEs).

Market Entry Strategy

To be successful in Indonesia, the presence of a local partner is highly important, it’s imperative to identify a local company that can represent your brand to targeted industries. The understanding of Indonesian culture, applicable regulations, and local consumer preferences are key factors to build the a successful business.

Market research

Expanding a business into a new market can be an exciting but challenging endeavor. When entering Indonesia, a local partner is critical to success, as they can represent the brand to the targeted industries and navigate local regulations and consumer preferences. Building a solid understanding of Indonesian culture and conducting thorough market research are essential factors to consider before making any decisions.

Conducting Market Research

Pricing, financing, technical skills, and after-sales service are just a few of the critical factors that impact purchasing decisions in Indonesia. Gathering insights on these factors requires a comprehensive market research approach to better understand the target audience, competitors, marketing channels, cultural differences, and potential growth. With the right data, a company can build an effective market entry strategy that considers all relevant aspects of the market.

Working with Agents and Distributors

When selecting a local distributor or agent, it’s essential to find a reliable partner that possesses a distributor’s license and has a thorough understanding of doing business in Indonesia. The right distribution partner should be able to provide support in navigating importation procedures and customs clearance, and also help expand sales within the country.

It’s important to differentiate between agents and distributors, as an agent represents the foreign principal, while a distributor acts for itself in marketing and selling the principal’s goods and services. Once an agreement is made between the foreign principal and the local distributor or agent, the agency/distributorship agreement and a statement letter from the Attaché of Trade of the Indonesian Diplomatic Representation in the principal’s country of origin must be submitted to the Ministry of Trade.

Selling Online or Offline

To market and promote products to the right audience, a local agent or distributor is crucial. They must introduce the products to key companies/segments and register them in advance of marketing. Some products, such as food and beverage and healthcare equipment, require registration before promotion and marketing. It is the local partner’s primary responsibility to introduce the brands and obtain initial recognition.

For B2B markets, e-procurement has been widely accepted to ensure transparency, efficiency, and accountability in the procurement of goods/services through electronic media. A good supply history with companies from similar industries in Indonesia or other ASEAN countries will increase the chance of being considered by targeted companies.

In recent years, e-commerce has also become an effective way to introduce and market products to a broader consumer class. Indonesia has the largest number of digital consumers in Southeast Asia, and post-pandemic, digital consumer demands have evolved significantly. While online channels are essential for product discovery and promotion, offline channels remain vital for the purchase stage, providing users with a better experience and feel of the products before completing the purchase.

Setting Up a Company in Indonesia

Setting up a branch or subsidiary is an effective way to enter the market. However, it is important to note that certain capital needs to be invested to establish a legal presence.

One of the most effective ways to establish a legal presence in Indonesia is to set up a Foreign Company Representative Office. This method is easier than setting up a limited liability company. However, it is essential to note the main differences between a Foreign Company Representative Office and a Foreign Investment Company.

Foreign company representative office

Is only allowed to supervise, liaise, coordinate, manage, and act as an intermediary for the foreign company’s business interests in Indonesia. The representative is not allowed to participate in managing a foreign company’s operations in Indonesia, generate any revenue in the country, and engage in any agreement or transaction for the sale or purchase of goods and services with an Indonesian company or Indonesian national. As such, the main foreign company is the only one through which all transactions can be handled.

Foreign investment company

Is described as investing activities to conduct business in the territory of Indonesia carried out by foreign investors, either using fully foreign capital or joint ventures with domestic investors. Foreign investors can only carry out business activities in large businesses, and the investment value should not be less than ± USD 670,000 (equals to IDR 10 Billion).

Market Entry Barriers

The Omnibus law bill established in 2020 aims to improve a conducive and attractive business climate for investors in Indonesia. However, some challenges still exist, such as labor relations, intellectual property protection, transparent rules setting and implementation, standards and certification, and pricing.

A study by TMF Group in 2021 mentioned that Indonesia was in the 6th position of Global Business Complexity Index. However, it has improved from the result in 2019 when the country ranked number 1. Thus, it is essential to conduct thorough market research before entering the Indonesian market

Product Standards and Labeling Requirements in Indonesia

In Indonesia, product standards and labeling requirements are in place to ensure the safety and quality of goods sold in the country. It’s important to understand these regulations before entering the Indonesian market.

Product Standards

Indonesia National Standard (Sertifikat Nasional Indonesia/SNI) is the only product standard required for 119 product categories. The list of products can be found here. The list has expanded much recently, and it’s advised to consult with a third-party for up-to-date information.

Labeling Requirements

All products sold in Indonesia are required to follow the latest labeling requirements. Every business actor use or complete Indonesian language labels on goods traded domestically. Certain products, such as food, beverages, and cosmetics, have higher labeling requirements since they need to be registered first in the Drug and Food Supervisory Body (Badan Pengawas Obat dan Makanan).

- Labels must be in clear, easy-to-read, and easy-to-understand Indonesian language (Bahasa Indonesia).

- If the language is not available or its equivalent cannot be created, Arabic numerals and Latin letters may be used.

- The identities of business actors, including at least the names and addresses of producers (for goods of domestic origin), importers (for goods of imported origin), packagers (for goods of domestic origin or of import which are packaged in Indonesia), or collecting traders must be included if they acquire and trade goods produced by micro and small businesses.

- The label must contain information on the name of goods, origin of goods, and the identity of the seller, at least containing the name and address of the producer (for goods produced in the country), importer (for goods of imported origin), packers (for goods produced domestically or of imported origin packaged in Indonesia), or collecting traders if obtaining and trading goods produced by micro and small businesses.

- Other information according to the characteristics of the goods must be included.

- Information or explanation in accordance with the laws and regulations must be provided.

- Goods related to the safety, security, and health of consumers and the environment must contain clear and easy-to-understand instructions for use and hazard symbols and/or warning signs.

- For goods that have mandatory Indonesia National Standard, the affixation of Indonesian language label shall follow the marking which is determined in Indonesia National Standard.

Import Tariffs

All taxable goods imported into Indonesia are subject to a 7.5% import duty and a 10% value-added tax. Due to the latest regulation in the country, importers now only have to pay 17.5% (previously, 27%) for taxable items. In the past, importers also needed to pay income tax of 10%.

Indonesia is taking part in various Free Trade Agreements. Here’s the list:

- ASEAN Trade In Goods Agreement(ATIGA)

- ASEAN-China Free Trade Area(ACFTA)

- ASEAN-Korea Free Trade Area(AKFTA)

- Indonesia-Japan Economic Partnership Agreement(IJEPA)

- ASEAN-India Free Trade Area(AIFTA)

- ASEAN-Australia-New Zealand Free Trade Area(AANZFTA)

- Indonesia-Pakistan Preferential Trade Agreement(IPPTA)

- ASEAN-Japan Comprehensive Economic Partnership(AJCEP)

Challenges of doing business in Indonesia

Indonesia’s government sees investment as a crucial driver of the country’s development. The Positive Investment List, issued in 2021, now enlists sectors open to 100% foreign investment, replacing the Negative Investment List that previously identified closed or restricted fields. The law now categorizes business lines into four types of foreign investment allowance:

- Priority sectors

- Fields with some restrictions

- Fields that require a partnership with Micro, Small, and Medium-sized Enterprises (MSMEs), and

- Fields completely closed to foreign investment.

Despite Indonesia’s attractive market potential, businesses must navigate certain challenges to effectively operate within the country. One of the most significant challenges is meeting the Local Content Requirements (LCR), which originated in the oil and gas sector but now applies to a broad range of economic sectors. Foreign companies must now source more than 75% of inputs for projects locally, presenting potential obstacles to their operations. However, those who see this requirement as an opportunity to promote their business will enjoy preferential treatment in tenders, particularly those initiated by state-owned enterprises.

Another key consideration for businesses supplying certain products, such as food and beverages, pharmaceuticals, cosmetics, chemical products, genetically modified products, biological products, etc., is obtaining a Halal certificate. This is necessary to ensure that products meet the religious standards of Indonesia’s predominantly Muslim population.

To effectively operate in Indonesia, companies must also address language and cultural barriers that can hinder effective communication and understanding of targeted industries. Though the business landscape can be complex, ARC Consulting offers expert assistance in navigating the terrain to help companies enter the market with their key solutions.

Summary

Indonesia boasts the largest population in Southeast Asia and boasts stable economic growth, making it a highly attractive market for international companies looking to expand their operations. The country’s growing economy, demographic bonus, rising middle class, and strong manufacturing capabilities all make it an attractive proposition for businesses looking to tap into its potential.

However, it’s important to note that doing business in Indonesia can come with its own set of challenges. One of the initial barriers is the language and cultural differences, which can make it difficult to understand the country and targeted industries.

As mentioned, there are several challenges and barriers that companies may face, which should be carefully considered. Navigating the entire landscape can be both capital and time-intensive, and assistance from a third-party is often required.

Read more about our market entry & expansion experience or other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.