Philippines’ electronics manufacturing industry dates to the 1970s when the country’s stable political environment and affordable, English-speaking workforce started to attract multinationals.

Starting from the assembly of basic chips, the industry has grown to produce advanced components like microprocessors, CD-ROMs, and computers. It became so vital to the country’s economy that companies in the industry established the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. (SEIPI) in 1983 to support its members and promote the industry.

In this article, we review the electronics industry in the Philippines, what products that can be produced, and the advantages and challenges of sourcing in the country.

The Electronics Industry in the Philippines

Together with Malaysia and Vietnam, the Philippines is one of the leading electronics manufacturers in Southeast Asia. Over the past 40 years, the country has welcomed notable industry players, such as Texas Instruments, Toshiba, and ON Semiconductor Corporation.

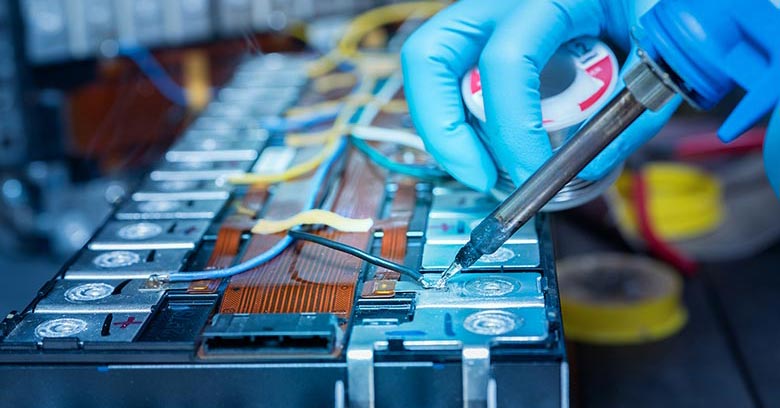

The country’s experience in electronics manufacturing has also spurred the growth of domestic Electronics Manufacturing Services (EMS) companies that provide advanced electronic components to the global market across various sectors, including semiconductors, industrial electronics, consumer electronics, and telecommunication equipment.

The rising tension between the US and China has made the “China + 1” strategy increasingly important for electronics companies. Due to its robust electronics manufacturing base and close relationship with the US, the Philippines is set to become one of the largest beneficiaries of this trend.

Products Manufactured in the Philippines

The Philippines is a top global exporter of electronics, with a particular strength in semiconductors. It also excels in producing telecommunication electronics, industrial electronics, and consumer electronics.

Semiconductors

The Philippines stands to benefit from the US-China tensions as semiconductor manufacturers look for other countries to avoid the impact of new restrictive US regulations such as the CHIPS Act.

In January 2023, the Semiconductor Industry Association (SIA), which represents 99% of the US semiconductor industry, recognized the Philippines’ role in reducing costs for US manufacturers in basic activities such as assembling, testing, and packaging semiconductors.

With more than 30-40 years of experience working with notable companies such as IMI, Inari Amertrond, and Cirtek, the Philippines is well-placed to provide these services with expertise and quality.

Industrial Electronics

Industrial electronics comprise components like drives, sensors, and industrial robotics used in industrial settings. The Philippines boasts notable industrial electronics producers, such as DAC Industrial Electronics and RS Philippines, which provide simple components such as sensors. More advanced and sophisticated products are also being produced such as industrial robots and automation control equipment.

Telecommunication Equipment

Between 2011 and 2021, the Philippines’ telecommunication export value increased by 156% from US$ 529 million to US$ 1.35 billion, according to the United Nations Conference on Trade and Development (UNCTAD).

Telecommunication equipment includes hardware such as routers, cables, and mobile devices. In January 2023, Nokia announced a major investment in the Philippines’ telecommunication sector to create a nationwide broadband network and a 5G network in Metro Manila.

Consumer Electronics

Philippines’ largest EMS manufacturers, including Inari and Cirtek, are particularly active in the consumer electronics sector. IMI, the country’s largest EMS manufacturer, is making consumer electronics for electric vehicles (EVs), which could potentially make the Philippines a leading EMS manufacturer for EV consumer electronics.

Benefits of Sourcing Electronics in the Philippines

The Philippines’ 40-year record in the electronics sector, skilled and English-speaking workforce, and relatively liberal foreign investment policies offer various benefits for companies seeking to source electronics.

Skilled workforce

The Philippines boasts a skilled workforce proficient in the English language, a critical factor for foreign investors. According to the 2022 EF English Proficiency Index, the Philippines ranks second only to Singapore in terms of English skills. This high level of English proficiency facilitates effective communication between staff and employers, enhancing work productivity.

Additionally, UNESCO data reveals that the Philippines has the third-highest educational attainment rate in Southeast Asia, behind only Singapore and Malaysia, in terms of years of schooling.

A large workforce at competitive costs

With a labor force of nearly 50 million, the Philippines possesses the third-largest labor pool in Southeast Asia, following Indonesia and Vietnam. Moreover, the country’s competitive wages are comparable to those of Vietnam, Cambodia, and Indonesia, while also being about 30% lower than that of Malaysia.

Strategic location

The Philippines enjoys a strategic location in the Asia-Pacific region, with easy and rapid movement to the most dynamic economic centers worldwide. Major cities such as Tokyo, Beijing, Ho Chi Minh City, Jakarta, Singapore, and Bangkok are all within 10 hours of flight time. Furthermore, the country is positioned between the strategic Malacca Strait, the busiest shipping lane globally, and the US, the world’s largest economy.

Free trade agreements

As a member of the Regional Comprehensive Economic Partnership, a free trade bloc comprising ASEAN member states, Australia, China, Japan, South Korea, and New Zealand, the Philippines benefits from free trade agreements in the Asia-Pacific region.

However, negotiations for an EU-Philippines FTA remain stalled due to the country’s ongoing drug war and its resultant high civilian casualties. Despite this, the absence of an FTA has not hindered the development of significant economic ties between the two sides, with a 2021 total bilateral trade volume of US$ 15 billion, making the Philippines one of the EU’s top 40 trading partners.

Investment facilitation policies

The Philippines has enacted investment facilitation policies that will help to reduce bureaucratic procedures in governmental services, including the 2018 Ease of Doing Business and Efficient Government Service Delivery Act. This Act aims to decrease the time businesses must spend on administrative tasks while increasing transparency within governmental departments and companies.

Moreover, since 2021, the Philippines has allowed 100% foreign ownership in public services such as telecommunications, airlines, shipping, and railways, making it one of the few countries in the world to do so. However, ownership restrictions still exist in areas such as ports, electricity, and water distribution.

The Philippines’ relatively lenient foreign ownership policies and efforts to reduce red tape are highly advantageous for foreign investors seeking entry into the country’s electronics market. With a skilled workforce, a large and affordable labor pool, and an advantageous location, the Philippines presents significant investment opportunities.

Challenges in Sourcing Electronics from the Philippines

While the Philippines offers many advantages as a sourcing destination for electronics, there are also some challenges that must be taken into account by potential investors. These include issues with infrastructure, corruption, and dependence on China.

Infrastructure

Former President Duterte initiated an ambitious “Build, Build, Build” infrastructure program in 2017. The program has cost about 7.3% of the country’s GDP in 2022 or an average of US$ 32.8 billion every year from 2017 to 2022.

Despite so massive a program, only 10% of the projects were completed by the end of Duterte’s presidency in 2022. In addition, although the Philippines has an extensive network of seaports, they are small in size. The Philippines’ largest Port of Manila is only ranked 31st by the World Shipping Council, behind countries such as Vietnam, Malaysia, and Indonesia. Furthermore, according to a survey from the World Economic Forum, the Philippines ranks as the third worst in terms of road connectivity in Southeast Asia.

The low port capacity and road connectivity mean that it will be challenging to move goods from factories to export ports rapidly.

Corruption

The Philippines ranks as the fourth most corrupt country in Southeast Asia, according to the Corruption Perception Index by Transparency International. The Bureau of Customs, a crucial governmental organ for many foreign investors, is perceived as one of the most corrupt by the US State Department. High levels of corruption pose a significant challenge for foreign investors in the country.

Dependence on China

Despite being one of Southeast Asia’s major manufacturing hubs of electronics, the Philippines still relies heavily on China for sub-components and raw materials such as integrated circuits and petroleum. This trend, however, has not shown any sign of abating, between 2021 and 2022, the Philippines’ electronics imports grew by 14.5%.

According to a 2019 report by the Electronic Engineering Times, the Philippines’ electronics contain about 80% sourced from abroad. These two factors make the Philippines’ electronics industry highly reliant on Chinese sources.

Semiconductor and Electronics Companies in the Philippines

The semiconductor and electronics industry plays a significant part of the country’s economy and is a vital component of the global supply chain. This industry offers a wide range of services, from design to distribution, and has attracted many foreign investors due to its affordable, English-speaking, and qualified workforce.

In particular, the top EMS companies in the Philippines are highly desirable due to their extensive experience in EMS manufacturing and their willingness to modernize their production systems to meet the growing demand for cutting-edge products like electric vehicles (EVs).

IMI

One of these leading EMS providers is IMI, which has been in operation since 1980 and has manufacturing, engineering, and sales facilities in ten countries worldwide. The company has focused its strategy on developing EV-related products, such as automotive cameras, EV charging stations, and power systems.

Cirtek Electronics

Another top player in the Philippine electronics manufacturing sector is Cirtek Electronics, which has been able to adapt to the ever-changing demands of customers since its inception in 1984. The company offers a wide range of products and services, from components for telecommunication devices to assembly, testing, and repair.

Inari Amertron

Finally, Inari Amertron, a result of an acquisition by a Malaysian company, has two major plants in the Philippines and is set to become one of the most cutting-edge EMS providers in the industry by leveraging Fourth Industrial Revolution technologies like the Internet of Things and machine learning.

Summary

Despite the advantages of investing in the Philippine electronics industry, there are still significant challenges to consider, such as the country’s reliance on China for sub-components and raw materials, high corruption, and inadequate infrastructure. Addressing these issues will be crucial to fully harness the potential of the country’s electronics manufacturing sector.

In conclusion, the Philippines has the potential to become a dominant player in the EMS industry. However, to realize this potential, it is essential to focus on improving infrastructure, reducing dependence on China, and addressing corruption to create a more conducive business environment for investors.

Read more about our sourcing & supply chain experience or our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.