Avoidance of public transportation due to serious air pollution, heavy traffic, growing free delivery services and elimination of plastic bags are giving added incentives to the online grocery business in Thailand.

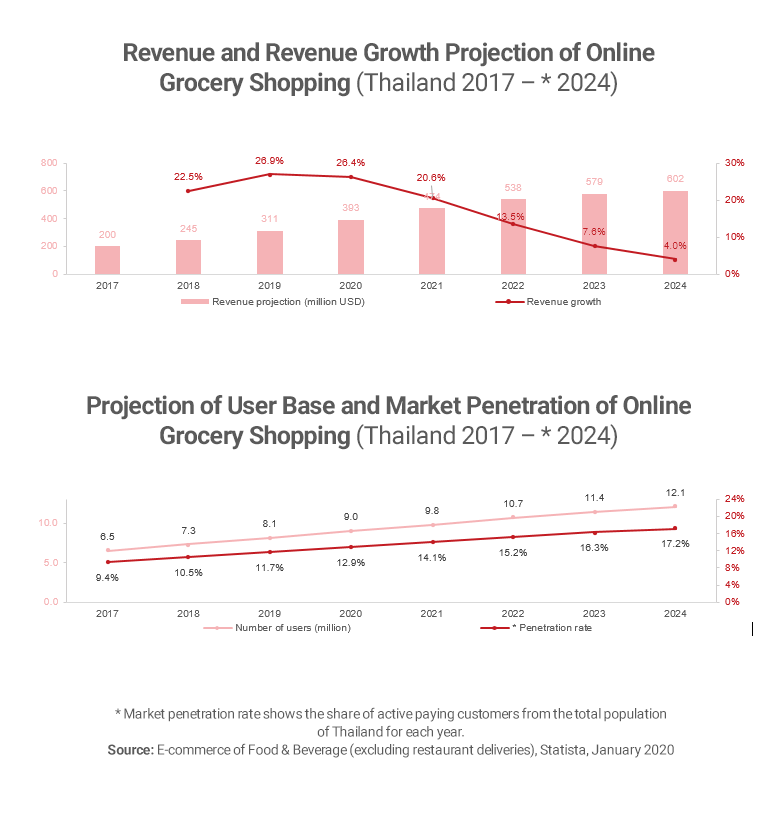

The grocery market value in Thailand was estimated to 30 billion USD in 2019. Looking at the online grocery market, it has been lagging behind other e-commerce categories for years, but has finally taken off, becoming one of the fastest-growing categories in Thailand. Between 2017 and 2019, the revenue from grocery e-commerce increased by 24.7% YoY and is expected to grow 26% in 2020. Correspondingly, the number of customers jumped from 6.5 million in 2017 to 8.1 million in 2019, and the market penetration rate reached 11.7% in 2019.

Adding to this, the Thai government kicked off 2020 with the ban on single-use plastic bags at major retail stores, aiming for a complete ban in 2021 to reduce waste and debris in the ocean. The ban has changed the shopping behaviour of the Thai people, adding to the inconvenience of shopping in-store. Additionally, traffic jams and air pollution have also been known as major concerns for the Thai residents. Consequently, more and more people are switching to the new, more convenient solution, which resolves all problems.

With its great potential of growth, the online grocery shopping market in Thailand has attracted multiple investors and new players, fighting over the online customers. Early players, such as Hoestbee and HappyFresh, have explored the Thai market and enjoyed the success on their own, until other Asian giants recently decided to enter. In 2020, Line, Grab, and Lazada are entering the market. While Grab and Lazada launched their own respective platform, Line joined forces with the existing online grocery platform HappyFresh. The cooperation will see HappyFresh using the Line Man platform, which has a large base of customers in Thailand. Traditional grocery retailers on the other hand, appear to be falling behind when it comes to online shopping. In late 2019, Tesco Lotus, one of the biggest “traditional” supermarket brands, launched their new online shopping site in partnership with Shopee, indicating that more investments toward the e-commerce sector is on its way.

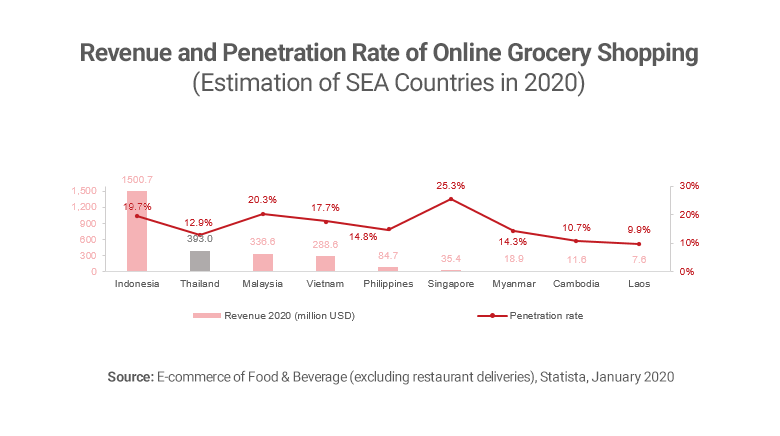

In 2020, Thailand’s grocery e-commerce is expected to reach 393 million USD and an estimated penetration rate of 12.9%. However, with consumers’ online spending growing by an impressive 25% last year, and factor such as air pollution, heavy traffic, bans of plastic bags, the future for Thailand’s grocery e-commerce industry looks promising.

Read more about our experience in the consumer products sector or our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.