Vietnam currently houses nearly 200 fintech firms, offering a broad range of services from digital payments to wealth management, P2P lending, and blockchain-based solutions. The rise of the fintech ecosystem in Vietnam is disrupting the overall financial industry, capturing markets that were once untouched by traditional banking, and along the way, gained a lot of attention from global investors.

A market set for exponential growth

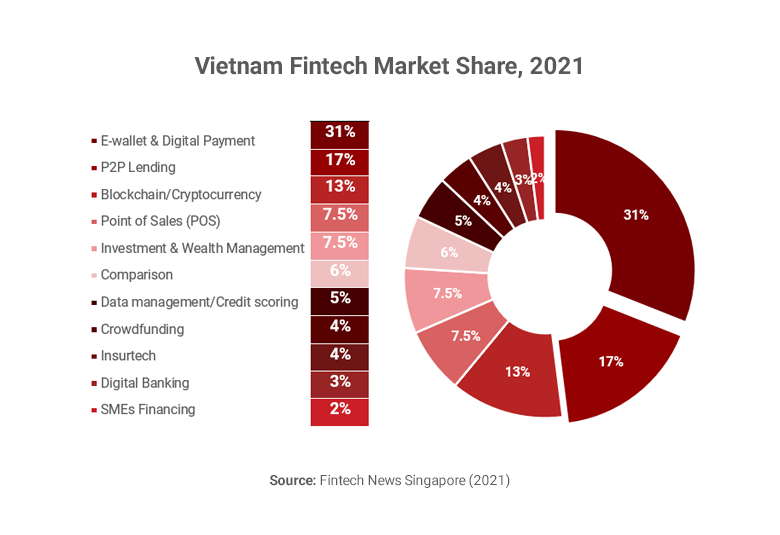

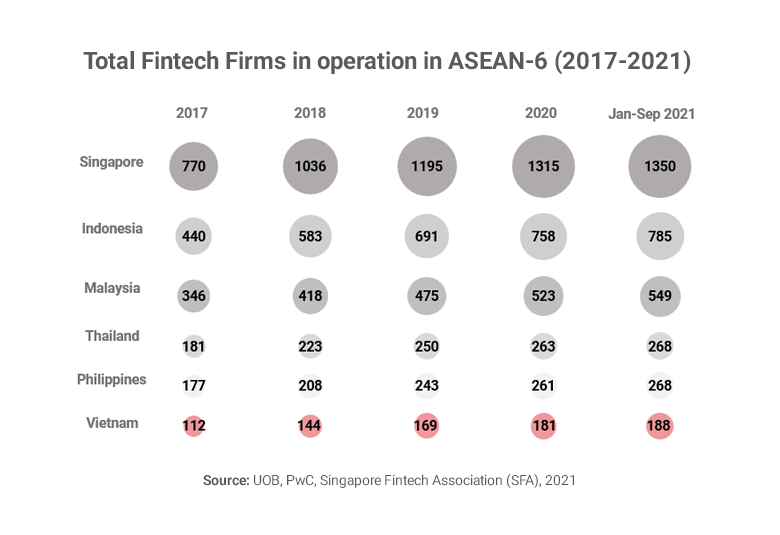

From a mere 39 firms in 2015, the size of Vietnam’s fintech industry grew dramatically to 112 in 2017, 169 in 2019, and approximately 188 by September 2021 (Tracxn, United Overseas Bank – UOB, 2021). The top sub-sectors accounting for 76% of the total fintech market share in Vietnam include digital payments, peer-to-peer (P2P) lending, cryptocurrencies and blockchain, investment tech, and point of sales.

Vietnam’s fintech industry has come a long way. However, it is still nascent, especially when compared with the other top 6 ASEAN economies (Singapore, Indonesia, Malaysia, Thailand, Philippines, and Vietnam). Vietnam currently has the lowest number of fintech firms in the group. The annual number of newly added firms has also been modest compared to the ASEAN-6’s results.

For investors and newcomers, the current small size of Vietnam’s fintech industry makes it particularly attractive for investment, as it still offers numerous gateways to get involved. The fintech market in Vietnam is only heating up, while in other ASEAN-6 countries, it is getting fiercely competitive and relatively saturated.

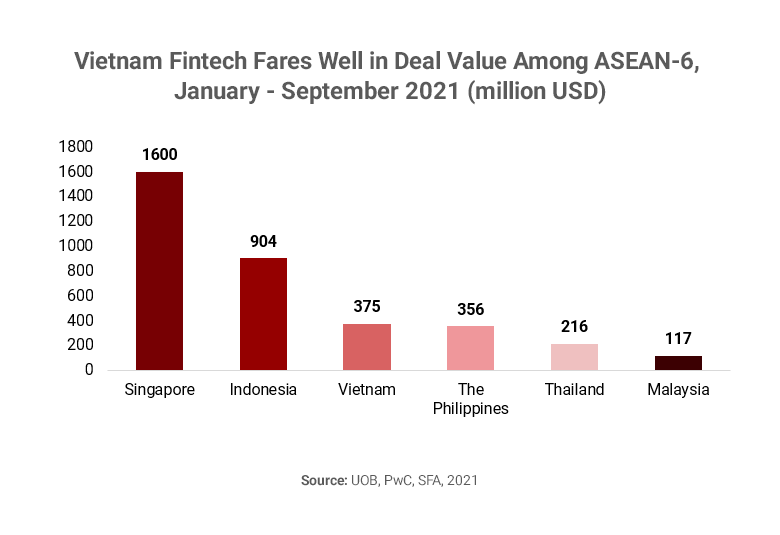

The attractiveness of Vietnam’s fintech industry is evidenced by the expansion of capital in both size and value. According to the FinTech in ASEAN 2021 report conducted by UOB, PwC, and SFA, Vietnam gathered 15 investment deals during the January-September 2021 period, placing the country in a joint third position with Malaysia, behind Singapore and Indonesia. The country also ranked third in fintech deal value, with 375 million USD funded in 2021, accounting for 11% of the total deal amount in ASEAN-6 2021. In comparison, funding in Vietnam’s fintech industry took up only 3% of total funding deals in ASEAN-6 in 2020.

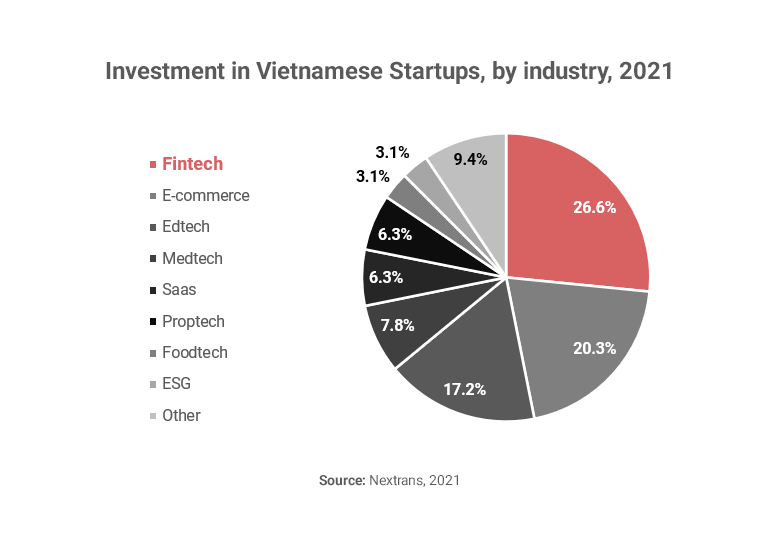

Major deals in 2021 include a 250 million USD investment into the payment solution company VNPay. Followed by two investments, worth 100 million USD (Series D) and 200 million USD (Series E) into e-wallet company MoMo (the second round was concluded in December 2021). Investments into Fintech startups also take up the largest share of investment value in startups in Vietnam 2021, with 26.6% of total investment.

A Diversifying Landscape

Vietnam is a predominantly cash-based economy, and more than 70% of the population does not have a bank account. The low financial inclusion is attributable to the limited access to financial information and banks in rural areas.

Yet, Vietnam is an increasingly tech-savvy market, with a 70.3% internet penetration rate and 63.1% of the population being smartphone users as of 2021. The COVID-19 pandemic also brought about a shift in Vietnamese spending habits. Contactless transactions are becoming the preferred choice of payment. SaaS cloud banking platform Mambu reported that around 85% of Vietnamese banking consumers are more likely to use online and digital banking services in 2021 compared to a year and a half ago. These factors create a huge opportunity for fintech companies to fill the gap.

Riding on the shift in consumer behaviour, digital wallet providers have proliferated in recent years, especially during the COVID-19 pandemic. The sector is getting intensely competitive with over 40 non-bank payment service providers. Familiar brand names include MoMo, VNPay, ShopeePay, ViettelPay, Moca (GrabPay), and Zalopay, which account for most of the current market.

Still, even the largest e-wallet companies are struggling to find a competitive edge, as tension is added from traditional banks also developing e-wallet functions. Most competitors are aiming to become super-apps, merging multiple services into one app, while attracting potential customers with marketing efforts and targeted discounts. Various mobile wallet apps have been providing other financial services, such as saving accounts, loan applications, and non-life insurance products in combination with discount vouchers and cashback offers.

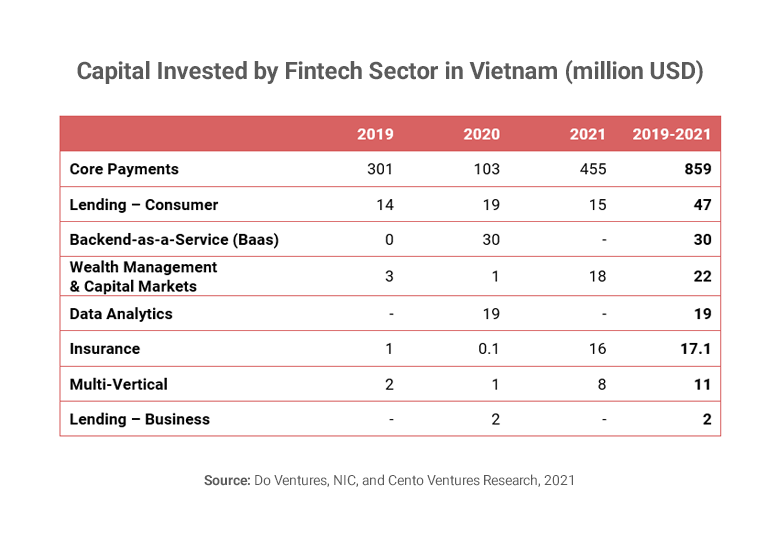

Digital payments remain the most attractive sector for investors. 85% of total capital invested in Vietnam’s fintech during the 2019-2021 period is in core payments, according to the Vietnam Innovation & Tech Investment Report 2021 by Do Ventures and Vietnam National Innovation Center (NIC). UOB explained in FinTech in ASEAN 2021 that due to concerns surrounding the prolonged pandemic, investors have turned to be more risk-averse and preferred to invest in mature fintech companies as they are deemed more resilient.

While digital payments will likely continue to dominate the fintech market, P2P lending is peaking up. P2P lending poses an attractive and convenient alternative to bank loans for both individuals and businesses, as most fintech firms in the field offer loans at relatively lower rates than traditional banks. According to a study by the World Bank, about 79% of people in Vietnam do not have access to formal financial services, including lending. There are also around 60% of small and medium enterprises (SMEs) that are not able to borrow from banks due to a lack of assets. The cluster presents a vast ground for development. Morgan Stanley also projected that the P2P lending model will be a global trend of the future.

Insurtech and wealth tech are also rising in popularity. According to Fintech & Digital Banking 2021 report by MBBank, the use of big data for analysis of demographics, consumer behaviour, social ecology, medical data, and biometrics in insurtech could significantly support the insurance industry in areas ranging from marketing to risk management, product development, pricing, and customer service. Adoption of technology opens opportunities for traditional insurance companies to provide flexibility in insuring policies and variability in pricing. Vietnam’s insurance market is growing at a steady pace. According to the Vietnam Department of the Insurance Supervisory Authority, Ministry of Finance, the total insurance premiums collected by insurance companies rose by 24.98% in 2021 compared to the previous year.

Several names have been establishing a strong foundation in Vietnam’s rising wealth tech industry. In February 2022, investment app Infina announced they have closed 6 million USD in their seed funding from Sequoia Capital, Y Combinator, and several other venture capitals. Infina, together with Finhay, is catering to the group of young, first-time investors whose needs have not yet been well-addressed by existing solutions in the market. There has been a recent surge in demand for retail investment assets in Vietnam recently. 1.53 million new retail stock accounts were opened in 2021, exceeding the previous four-year total. Purchases of cryptocurrencies as investment assets are also on the rise. It is estimated that approximately 5.9 million Vietnamese people are current holders of virtual assets. That is 6.1% of the total population (TripleA, 2021). Given the rising interest in investment from the overall public, tech firms in the field could easily expect to attract a wider customer base in the future.

An Ecosystem Strongly Backed by Government

The Vietnamese government has been encouraging the adoption of advanced technologies by introducing several regulations in favour of the banking and financial services sector. In March 2017, the State Bank of Vietnam (SBV) established a Steering Committee on Financial Technology dedicated to the building of a regulatory framework for the development of the fintech ecosystem and creating opportunities for local fintech companies.

A five-year project (2021-2025) has been approved to support the development of cashless payments. The project aims to accelerate the growth of cashless payments with improved security, safety, and confidentiality, and to make it more accessible to residents in all areas, including rural, remote, and mountainous places. In numbers, the project aims to increase the value of non-cash payments to be 25 times higher than the GDP, and the proportion of cashless payments in e-commerce to reach 50% by 2025. Additionally, the project attempts to close the current gap in financial inclusion, lowering the rate of the unbanked population to 20% among people aged 15 and over.

The Ministry of Finance, in collaboration with the SBV, has established a regulatory sandbox to further boost the financial ecosystem. The pilot regulatory program will enable businesses in various fintech sectors, including P2P lending, payments credit, and consumer identification, to participate. A research group is also in place to cover policies for virtual assets and cryptocurrencies. The sector currently has no regulation in place, even though Vietnam is already ranked top 10 among 154 countries in Chainanalysis’ Global Crypto Adoption Index from 2020.

While there is a need to tighten regulations to hinder malicious acts in the industry, the government is allowing a lot of space for foreign investors to take up ownership of fintech firms.

A Magnet for Capital

Vietnam, with a young, urban, and tech-oriented population, is seeing accelerated growth in fintech adoption. Within the last 6 years, the industry has expanded by over 5 times. And yet, there is still an enormous ground for new players to enter the market, given the current small size of the industry in comparison to the vast population of Vietnam.

Aside from the digital payments sector, which has been in fierce competition, Vietnam’s fintech industry also has rising startups in alternative lending, wealth management, and cryptocurrency, among others. The rate of adoption in each sector has been impressive, for both B2C and B2B business models. For most customers, fintech opens new doors that were once deemed inaccessible with the traditional brick-and-mortar financial services.

In parallel with the growth of technology integration in financial services, the government has been relentless in rolling out regulatory strategies to adapt to new business models, including the opening of the research centre and regulatory sandboxes. It also strives to sustain a favourable environment for foreign investors, balancing tightening regulations to reduce risks and allowing the market to grow through foreign investments.

All these factors combined make Vietnam’s fintech industry a promising opportunity for investors. There has been a surge in fintech investment in Vietnam recently, and we could undoubtedly expect to see a much more dynamic inflow of capital in the future.

Read more about our technology sector experience or other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.