FDI Inflows into Real Estate

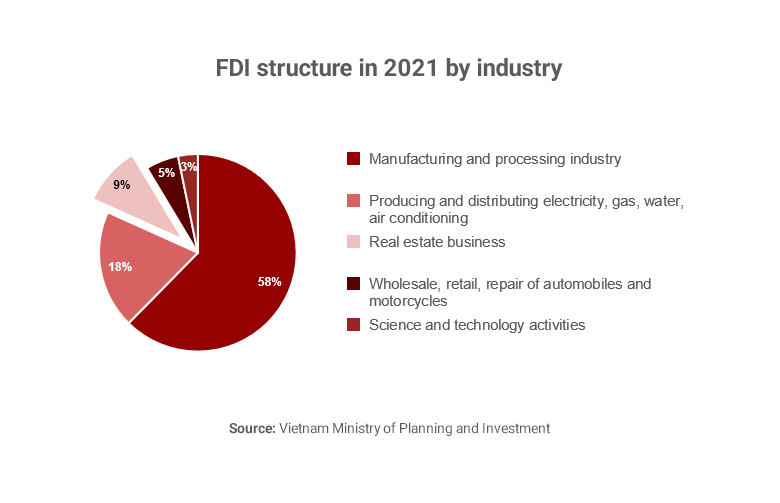

According to the Ministry of Planning and Investment of Vietnam, the total registered foreign direct investment (FDI) in Vietnam reached 31.15 billion USD in 2021, up 9.2% compared to 2020. Included was the real estate business sector which ranked 3rd with an FDI value of more than 2.6 billion USD (accounting for 8.3%).

Rent for land is forecasted to continue to increase by 6-10% (YoY) in 2022 in both the South and the North of Vietnam, due to high demand and limited available landmass. In 2022, this sector will maintain its attractiveness thanks to the increase in available land that will meet the market’s demand.

Industrial Real Estate

Industrial real estate is the most notable sector in the industry. Although Vietnam had to cope with harsh lockdowns following a strong spread of the COVID-19 virus in the first months of 2021, the industrial real estate market still witnessed many positive activities with big investments. Some notable investments include Jinko Solar Company (Hong Kong – China) invested nearly 500 million USD in Song Khoai Industrial Park (Quang Ninh province), and Fukai Technology Company (Singapore) invested 270 million USD in Quang Chau Industrial Park (Bac Giang province).

In terms of the occupancy rate (the ratio of rented space to the total amount of available space) in industrial areas, high occupancy rates in the Northern Key Economic Zone were recorded in 2021: 95% in Bac Ninh, 90% in Hanoi, 89% in Hung Yen, and 73% in Hai Phong. In the South, occupancy rates in Ho Chi Minh City were 88%, Binh Duong 99%, and Dong Nai 94%. The high rates are promising signs for the industrial real estate industry, as foreign investors are shifting their investments to domestic industrial parks.

The attraction of industrial real estate in Vietnam can be explained by two main reasons. Firstly, with clean premises, complete infrastructure, and abundance in labour, industrial parks in provinces and cities such as Hanoi, Vinh Phuc, and Hung Yen are attracting foreign investors. Secondly, the participation of Vietnam in many free trade agreements, most recently the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the Free Trade Agreement between Vietnam and the EU (EVFTA), as well as the Regional Comprehensive Economic Partnership (RCEP), makes Vietnam an attractive destination for foreign investors.

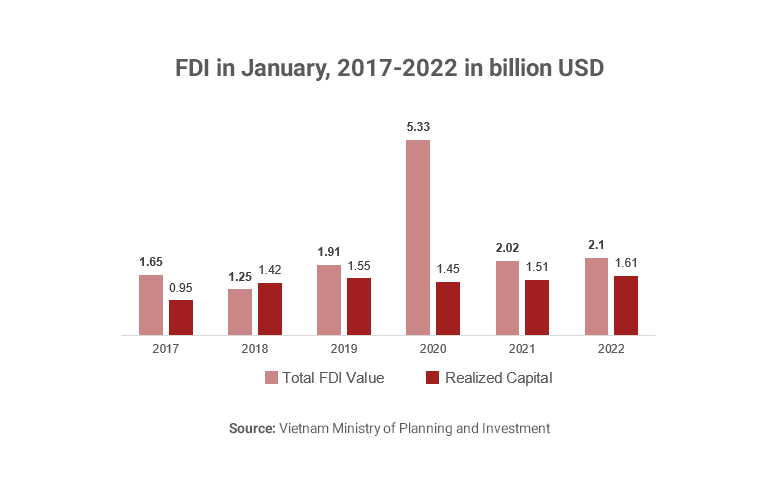

Upcoming Trends That Accelerate the Growth of Real Estate

First, a remarkable change in Vietnam’s COVID-19 strategy is expected to bring positive impacts to the real estate prospects and the country’s economy as a whole. From October 2021, the Vietnamese Government abandoned their “Zero COVID-19”-strategy, instead, they adopted the strategy of “safe, flexible adaption and effective control of COVID-19”. This change has eased investors’ anxiety and hesitation over investing in the country. Growing FDI inflows from both newly registered capital and increased capital in the very first month of 2022 reflect the newfound confidence that investors have in the prospect of Vietnam’s industrial market, thereby creating momentum for developing the industrial real estate industry. Notably, FDI inflows are now not only concentrated in the Northern and Southern key economic areas of Vietnam, but also spread to more developing and potential areas such as Quang Tri, Nghe An, and Ha Tinh in Central Vietnam.

Second, the Vietnamese government has planned to boost public investment in infrastructure by 2022, creating an impetus for industrial real estate. Currently, the National Assembly has approved an economic stimulus package worth 347,000 billion VND (appx. 15.2 million USD). The package includes capital to implement a group of solutions to develop infrastructure, and amounts to 113,850 billion VND (appx. 5 million USD), focusing on the development of 13 important traffic projects.

Third, the boom of e-commerce in Vietnam has led to an increased need for inventory, thereby boosting demand for industrial land such as warehouse services. According to the Ministry of Industry and Trade of Vietnam, the country’s e-commerce revenue is experiencing a CAGR of 44.9% 2020-2025, and is expected to reach 52 billion USD at the end of the period. It is estimated that if the revenue from e-commerce reaches 25-27 billion USD, about 350,000 m2 of new warehouse space will be required, which means that by 2025, Vietnam will need 700,000 m2 space for e-commerce warehouses alone.

Lastly, Vietnam plans to accelerate the expansion of new land supply in the Red River Delta and North Central – Central Coast. Industrial land supply is expected to increase by 44,760 hectares in 2022-2025 in order to meet the increasing demand for renting land in Vietnam. In addition, finished warehouses and factories will continue to be attractive in 2022 with many domestic and foreign investors looking for opportunities to enter the market entering.

Summary

The easing of Vietnam’s COVID-19 prevention measures, along with an acceleration in vaccination has led the economy on the path to gradually recover back to normal, which has sent a positive signal to investors. This is a catalyst not only for the industrial real estate market, but also for the real estate market in general, creating a breakthrough momentum. Additionally, with its steady growth rate, export-oriented economy, increasing free trade agreements, young workforce, preferential investment policies, and strategic geographical location, Vietnam is expected to continue to be an attractive destination for real estate investors.

Read more about our experience in industrial goods and services or our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.