The start-up scene in Vietnam has developed rapidly in the past decade, benefitting from factors such as governmental policies, tax incentives, and changes in consumer behaviours. The industry has been recovering fast post-pandemic and is expecting a speedy recovery in foreign investments as well.

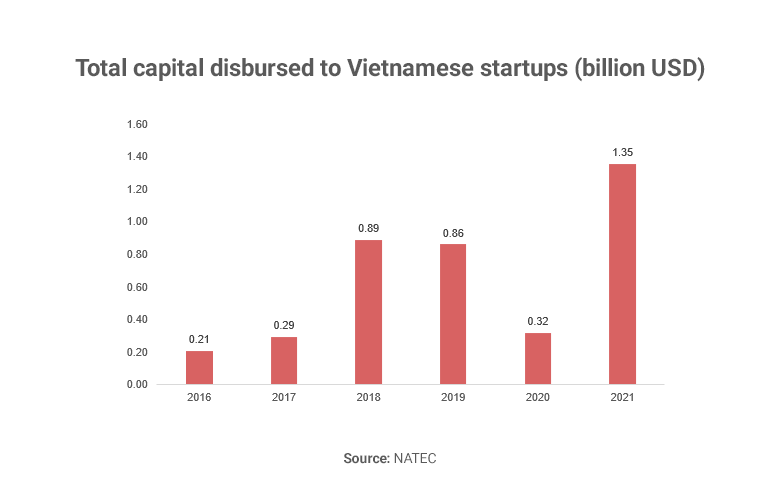

The National Agency for Technology Entrepreneurship and Commercialization (NATEC) reported that the total capital invested in Vietnamese startups reached more than 1.3 billion USD in 2021 – 4 times higher than that of 2020. This is also the highest amount recorded over the past few decades, beating the former record of almost 900 million USD in 2018 and 2019.

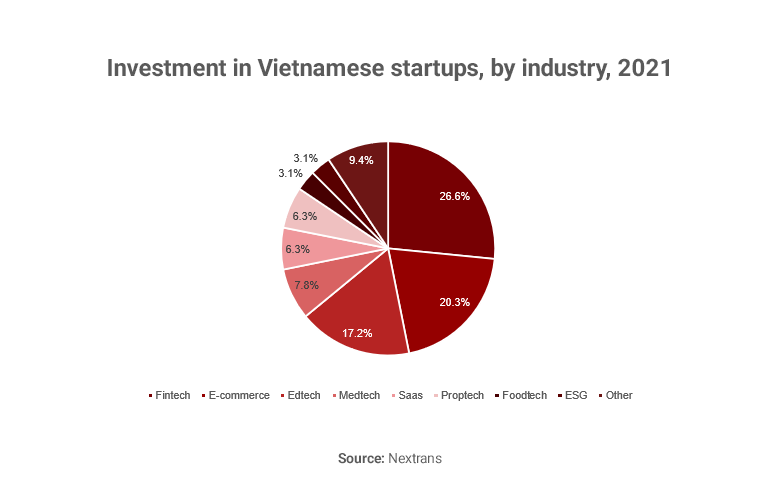

Vietnam has developed rapidly and has become the third most active startup ecosystem in Southeast Asia (SEA) since 2019. Indonesia and Singapore hold the first and second positions respectively. The country now recognizes a total of nearly 4 000 startups, including the four unicorns: VNG, VNLife (VNPay), M_Service (Momo), and Sky Mavis. Out of the total investment value of 1.3 billion USD in 2021, many deals are worth several hundreds of millions USD each. Some notable investments include the 250 million USD investment into VNLife (Series B), 258 million USD in Tiki (Series E), 200 million USD in Momo (Series E), and 45 million USD in KiotViet (Series B). The large investments into these start-ups highlight how the capital market is focusing on tech-related businesses, particularly fintech. This trend can partially be explained by the COVID pandemic as consumer behaviours significantly shifted towards a digital lifestyle and technological innovations, such as cashless payments, e-commerce, ed-tech, and med-tech.

Investments into tech-related startups accounted for the majority of the deals made in Vietnam 2021. Fintech accounts for the highest proportion, with 26.6% of total investment. This is followed by E-commerce (with 20.3%) and Edtech (17.2%). The two notable deals in VN life and Momo, both worth more than 100 million USD respectively, undoubtedly contributed to Fintech’s high share of total investments in the country.

Even though total investments into Vietnamese Startups dropped in 2020 due to the pandemic, investments grew significantly in 2021, even surpassing the investment value of 2019. At the beginning of the pandemic, foreign investors and funds were hesitant to disburse their capital due to uncertainties in the economy, as well as travel restrictions preventing investors from having face-to-face discussions and negotiations with potential investees.

However, venture capitalists have faith in a speedy recovery of Vietnam’s economy. Many business ideas that were paused are also resuming after being postponed due to the pandemic. Investors have also adapted to digital working tools, thus easing the deal process even after the pandemic. Consequently, experts believe that capital inflow will increase strongly looking ahead, with active participation from several new asset management giants, such as KVision (Kasikorn Group), Bace Capital (Alibaba), Sequioa Capital, and the Swedish VC firm Antler.

Support from the government

Many regulatory documents have been issued or revised in the last decade to support the growth of startups, especially tech-related ones.

For example, in 2017, the prime minister issued two decisions that support female and student entrepreneurs. Measurable goals were set with targets stretching to 2025. In the plan, the government plans to support at least 20 000 female entrepreneurs in starting businesses, providing them with training and support in the process. In addition, the plan also includes providing proper funding for students’ start-up ideas in all universities and colleges.

The government also decided to establish the National Innovation Center (NIC) in 2019. Supervised by the government, the centre provides various types of support for start-ups in the country, including networking opportunities, working space, mentorship programs, and funding.

Another example is the issuance of Decree 13 from 2019 set by the Government, as well as the Circular 03 document created in 2021 by the Ministry of Finance. The two documents introduced tax incentives for tech-related companies in Vietnam. Eligible companies can have their corporate income tax rate at 10% for the first 4 years, and a 50% tax reduction in the subsequent 9 years.

Impact of COVID-19

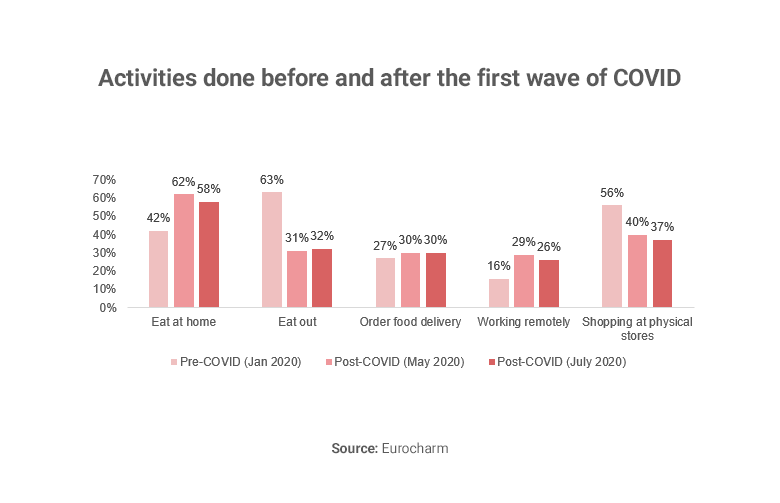

Despite the adverse impact of COVID-19, the pandemic also created several opportunities for businesses, especially SMEs. While the large conglomerates struggled with adjusting their entire operations according to the development of the pandemic, SMEs were more flexible in changing their operation and were even able to find benefits in the situation. Most advantages could be found in issues related to for example medicine, education, and remote working.

Moreover, consumers’ behaviour has also been changing over the course of the pandemic, notably in the shift toward digitalization. E-commerce first started becoming popular in Vietnam in 2016, making up only 3.3% of total retail sales at that time. However, this figure climbed up to 10% by the end of 2021, up from 5.5% in 2020 and 4.9% in 2019.

Vietnamese startups, especially tech-related ones, have been largely favoured in recent years, seeing particular benefits following the effects of the pandemic. Experts are expecting an even brighter year for start-ups in 2022, as the country is entering its recovery phase after having had several lockdowns and travel restrictions since April 2021 following the fourth wave of COVID. Governmental support has been rising, introducing several beneficial schemes (funding, supporting agencies etc.) that help SMEs to have broader access to capital, know-how, and technology. Vietnam’s start-up scene is proving favourable for any entrepreneurs or investors wanting to enter the market, and expecting high growth ahead.

Read more about our market entry services or other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.